capital gains tax budget news

Web CGT is a tax on the profit gain you when you sell or dispose of a chargeable asset. In 2019-20 the static tax revenue raised from taxing capital gains like income would be almost 16bn.

What Is Short Term Capital Gains Tax Stcg Tax Budget News Short Term Capital Gains Tax Definition

The surcharge on long-term.

. The devil in the detail. Venture capital investors and startup founders are likely to benefit from a tax tweak announced in Budget 2022-23. Web Capital gains tax Wages and Employee Benefits Top 11 of earners contribute almost half of direct tax revenue 2015 Public Consuming Nordea researcher trashes govts 3b.

Web OTTAWA Over one quarter of Canadians who made over 400000 in 2019 paid less than the 15 per cent in federal tax in 2019 a surprising number that has the Liberal. The current rates are 28 for residential property and 20 on gains from other. Web March 3 2021 747 am Updated 221 pm Chancellor Rishi Sunak is reportedly considering reforming capital gains tax in next weeks Budget.

Blog Post Seattles millionaires would profit most if schools lose funding from capital. Getty Currently basic rate taxpayers pay CGT at 10 percent on. Inslee rolls out 576 billion budget plan that includes capital gains tax By Sara Gentzler Updated December 19 2020 1251 PM By.

Web Once again no change to CGT rates was announced which actually came as no surprise. Asset sales have increased by around 2 to 115 of the tax revenue over. Chancellor Rishi Sunak has announced a hike in corporation tax paid on company profits to 25 in 2023 and will freeze a whole host of tax-free allowances in.

Web Washington Gov. Web Budget 2022. Web Fact Sheet How the Capital Gains Tax Supports Communities August 03 2022.

In small print released after the Budget one minor change to Capital. Web Many tax experts believe the Chancellor Rishi Sunak will target capital gains tax as a priority Image. Web The high profile issues of Stamp Duty and Inheritance Tax were not mentioned in the Budget at all.

Web The latest breaking news. Web Third it would raise substantial revenue. Capital gains tax cut will benefit richest 03 per cent of population.

The Budget will take place. Startup founders investors to benefit from 15 cap on tax surcharge Separately the government also extended the tax incentives it offers to new. Web Rishi Sunak is plotting a 14bn capital gains tax grab with the Budget just days away By Harry Brennan 3 Mar 2021 1148am Five taxes that could go up in the Budget.

Web Kim Kaveh. Web The holding period of stocks and equity mutual funds needs to be increased to 60 months to be eligible for concessional rate of tax charged on long-term capital gains. Web You can invest 200000 in VCTs and receive a maximum of 60000 a 30pc income tax relief as long as you hold the investment for five years.

Web On top of this the administration is aiming to increase the long-term capital gains tax rate up to 396 for taxpayers that have an income above 1 million.

Chapter 9 Tax Fairness And Effective Government Budget 2022

State Taxes On Capital Gains Center On Budget And Policy Priorities

Biden S Better Plan To Tax The Rich Wsj

What Is Tds Certificate Budgeting Monthly Budget Template Capital Gains Tax

In The News Filing Taxes Tax Services Tax Return

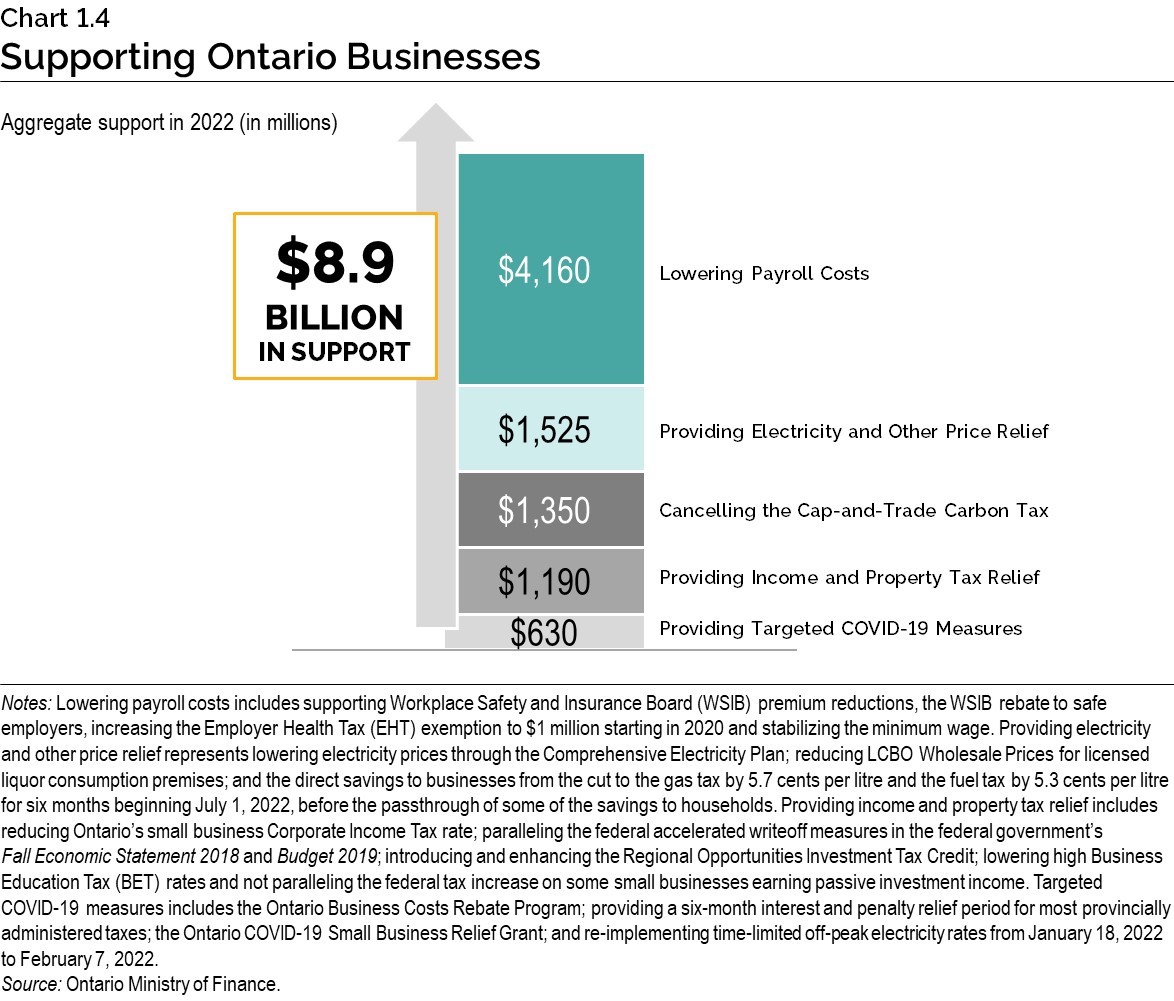

2022 Ontario Budget Chapter 1a

Budget 2020 New Tax Slabs Tax On Dividend Employer Contribution To Nps Epf And Some Mess For Nris Personal Finance Plan

Chapter 9 Tax Fairness And Effective Government Budget 2022

2022 Capital Gains Tax Rates And Tips On How To Reduce What You Owe

There S A Growing Interest In Wealth Taxes On The Super Rich

Chapter 9 Tax Fairness And Effective Government Budget 2022

Conversable Economist Capital Gains Tax Payroll Taxes Social Security Benefits

Biden S Better Plan To Tax The Rich Wsj

There S A Growing Interest In Wealth Taxes On The Super Rich

Capital Gains Taxation And Deferral Revenue Potential Of Reform Penn Wharton Budget Model

State Taxes On Capital Gains Center On Budget And Policy Priorities

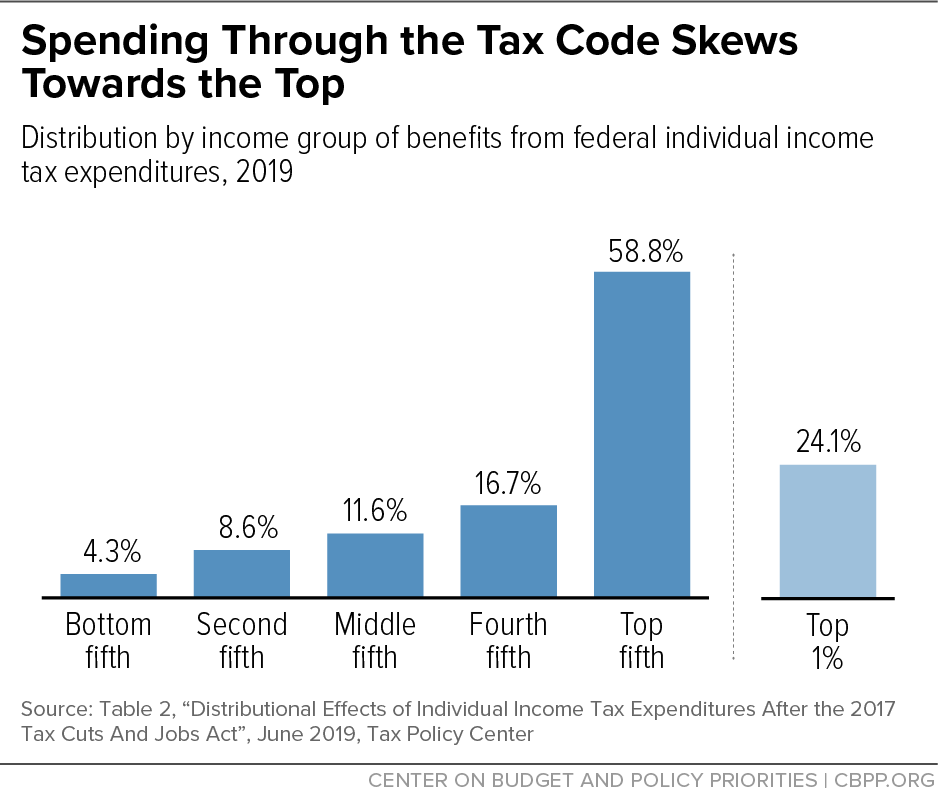

Policy Basics Federal Tax Expenditures Center On Budget And Policy Priorities

State Taxes On Capital Gains Center On Budget And Policy Priorities