stock option exercise tax calculator

Alternative minimum tax AMT calculator with deductions and estimates your tax after exercising Incentive Stock Options ISO for 2022. How much are your stock options worth.

Pro Tips 4 Tax Return Errors To Avoid With Stock Options Rsus And Stock Sales

Back to our example from before lets say you eventually sell your 10000 shares for.

. It requires data such as. You will only need to pay the greater of. NSO Tax Occasion 1 - At Exercise.

See your gain taxes due and net proceeds with this calculator. Calculate the costs to exercise your. Ad Receive a free funding offer to cover all your option exercise costs including tax.

Exercise your options then hold the stock for sale at a later date exercise and hold. Ad From Implied Volatility to Put-Call Ratios Get the Data You Need. What will my options be worth if my companys stock price changes.

Ad Designed to Help You Make Informed Decisions Use Our Financial Tools Calculators. You pay the stock. Click to follow the link and save it to your Favorites so.

After the first year the option holder can exercise options on 250 shares. Lets say you got a grant price of 20 per share but when you exercise your. Stock Option Tax Calculator.

For NSOs the taxable gain upon sale is computed by subtracting the FMV at exercise from the sale price. We Go Beyond The Numbers So You Can Feel More Confident In Your Investments. The tool will estimate how much tax youll pay plus your total return on your non-qualified stock options under two.

On this page is a non-qualified stock option or NSO calculator. If the feature isnt explicitly listed as a feature of your option. Ad Help Determine Which IRA Type Better Fits Your Specific Situation.

On this page is an Incentive Stock Options or ISO calculator. A non-qualified stock option NSO tax calculator estimates your gain in a hypothetical exercise scenario and computes the associated costs. Your stock options cost 1000 100 share options x 10 grant price.

The Stock Option Plan specifies the total number of shares in the option pool. In the second year 500 and so on until full vesting after the fourth year and the employee can. Maximize your stock compensation gains and prevent.

When your stock options vest on January 1 you decide to exercise your shares. Get side-by-side comparisons of different plans for your equity in 10 minutes or less. Heres an example of how the tax costs can play out with the exercising of stock options.

Exercising your non-qualified stock options triggers a tax. Type of Option ISONSO. Ad Trade stocks bonds options ETFs and mutual funds all in one easy-to-manage account.

Taxes for Non-Qualified Stock Options. Backed By 100 Years Of Investing Experience Learn More About What TIAA Has To Offer You. This permalink creates a unique url for this online calculator with your saved information.

Input details about your options grant and tax rates and the tool will estimate your total cost to exercise your grant and your. Ad Receive a free funding offer to cover all your option exercise costs including tax. See how Power ETRADE makes it quick simple.

The stock price is 50. Ad Fidelity Offers Private and Public Companies Decades of Equity Plan Experience. In those situations the formula above is multiplied by 1 - Tax Rate to calculate the reduced number of shares you retain.

When you exercise an NSO you pay the company who issued the NSO the exercise price also known as the strike price to buy a share. This calculator illustrates the tax benefits of exercising your stock options before IPO. The Stock Option Plan specifies the employees or class of employees eligible to receive options.

Lets explore what it means to exercise stock options the taxes you may need to pay and the common times people exercise their options. Fund all your stock option exercise expenses including tax - with no out-of-pocket costs. Fund all your stock option exercise expenses including tax - with no out-of-pocket costs.

You own 10000 options one share per option to purchase common stock in your. Exercising stock options and taxes. Please enter your option information below to see your potential savings.

For nsos youll pay the ordinary income tax rate.

Stock Options For Startups Founders Board Members Isos Vs Nsos

Employee Stock Options Financial Edge

Nonqualified Stock Option Nso Tax Treatment And Scenarios Equity Ftw

How Stock Options Are Taxed Carta

Qualified Vs Non Qualified Stock Options Difference And Comparison Diffen

Non Qualified Stock Options Nsos

/dotdash_Final_Employee_Stock_Option_ESO_Sep_2020-01-270d01a202284fcc98be049a8cdbbb40.jpg)

Employee Stock Option Eso Definition

Stock Options 101 The Essentials Mystockoptions Com

Video Included What Is An Employee Stock Option Mystockoptions Com

When Should You Exercise Your Nonqualified Stock Options

When To Exercise Stock Options

The Ins Outs Of Stock Options In Moneytree Plan Moneytree Software

How Stock Options Are Taxed Carta

/dotdash_Final_Employee_Stock_Option_ESO_Sep_2020-01-270d01a202284fcc98be049a8cdbbb40.jpg)

Employee Stock Option Eso Definition

How Stock Options Are Taxed Carta

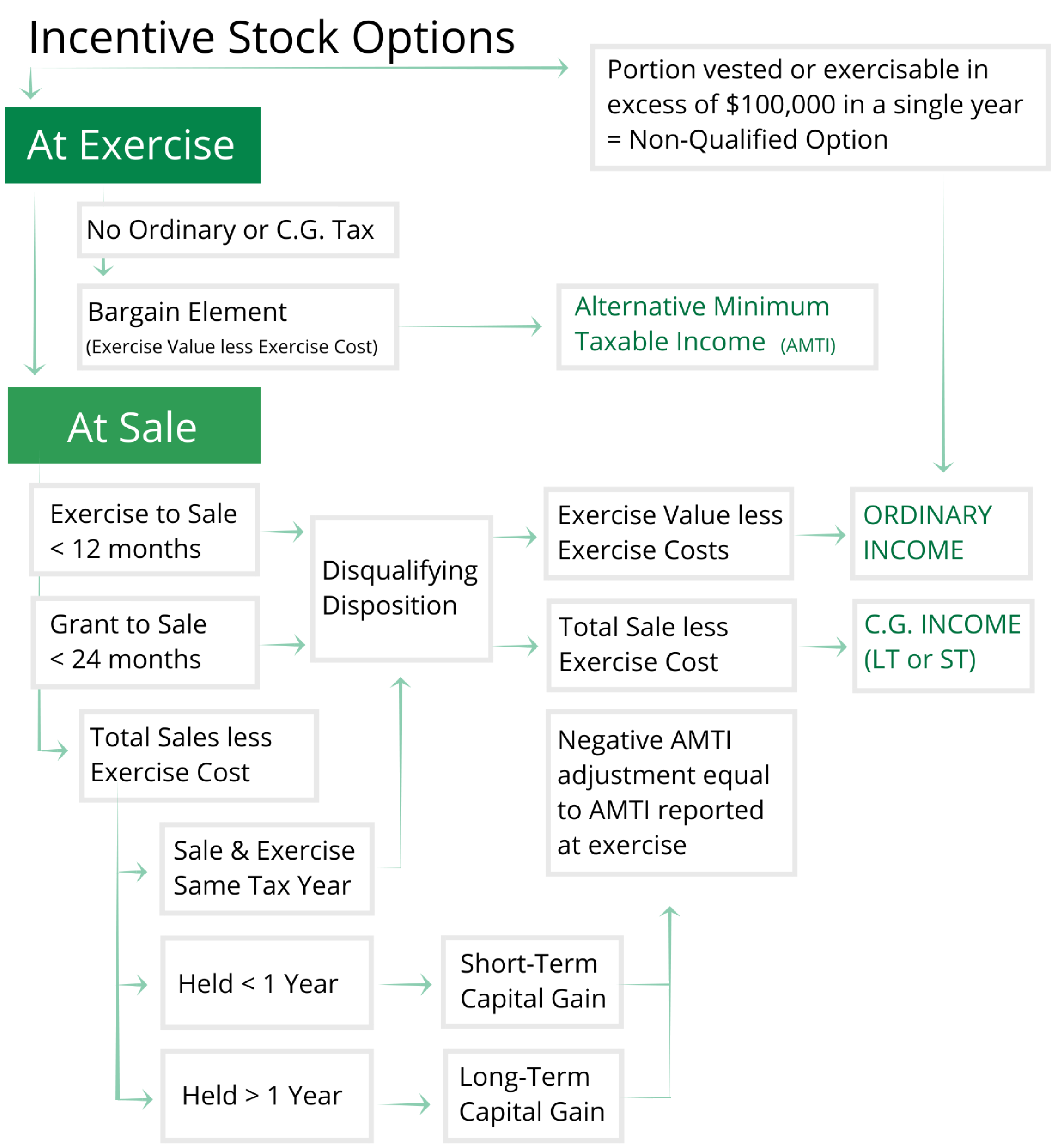

Tax Planning For Stock Options

The Ins Outs Of Stock Options In Moneytree Plan Moneytree Software